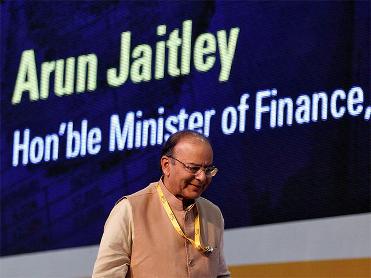

The effect of note ban on monetary development, financial shortage, and occupations and expenses are set to highlight unmistakably in Arun Jaitley's budget speech of 2017. With only 6 days to go for the yearly financial plan presentation, finance minister Arun Jaitley may come with different revisions in different conditions identified with any number of Acts, however important fact is the way that people ought to get profited the most.

Here are the pre-budget desires from Arun Jaitley's financial plan 2017 speech:

Demonetisation

In the midst of challenges against the sudden rejecting of old money takes note of, the government is accepted to give last touches to a complete strategy to dishearten people from utilizing money exchanges. All things considered there are desires that finance minister Arun Jaitley will taxes and rebates and motivating forces to empower transactions through cards and digital means. A few specialists trust that the finance minister may likewise report measures to expense money withdrawals from banks over an edge.

GOODS AND SERVICE TAX (GST)

With the first due date of April revealing the new Indirect tax system look missed for now, finance minister Arun Jaitley is broadly announce Goods and Services Tax (GST's) execution plan in the upcoming budget 2017-18. Once implemented, GST, charged as India's most eager changes move, will fasten together a typical national market, dismental financial barriers among states and unite an patchwork of neighborhood and focal obligations, for example, excise into a single levy.Income Tax

After GST, coordinate expense changes may likewise be in center in the current year's financial plan. Expect big declarations in the wage charge pieces and rates. Finance minister Arun Jaitley may raise tax cuts offered on cash stopped in settled stores, protection premium and shared assets from Rs 1,50,000 to Rs 2,00,000 a year under the famous Section 80C plan. The move is planned to urge individuals to move their extra cash into the financial system, rather than stocking up money.Corporate Tax

The government is required to cut the corporate wage impose rates by 1.25-1.5 percent to 28.75-28.5 percent in the financial plan 2017, however will probably remove exemptions that permit companies to eliminate their powerful tax payments. The move, which the fund serve had initially declared in 2015, will flag the start of changes in India's complex tax system that had turned out to be buried in layers of exclusion and sops throughout the years, making it hard to control.

No comments:

Post a Comment